Skip to content

- The capitalist faith derives many sentiments from Christianity.

- Among which is the penal substitution for sin and infinite debt; Christ/God himself self-sacrificing for mankind’s sin and ultimately being a Creator-God for all creation – which the guilty debtor cannot repay.

- The priests invented the debt and the God, to gain political and earthly advantage.

- This morphed into capitalist relations, whereby the concept of infinite growth came into being to pay the infinite debt.

- Capitalists expected a return on their capital – interest – to live off and expected the labour component to work and extend the capital.

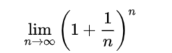

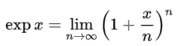

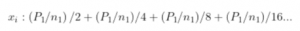

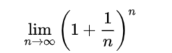

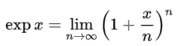

- This expected return, capital plus interest, follows an exponential function:

- The radius of convergence for the exponential function is infinite.

- Hence the infinite growth paradigm of capitalism will always lead to resource obliteration on a sphere of finite materials.

- The human apes with limited scope of foresight and mathematical acuity tend to follow their herd when forced into the right circumstances and will never question how infinite growth can appear – resource depletion, inflationary monetary policies etc…

- I assert that the desire for a passive income from interest on capital can be rooted in the need for comfort in a chaotic universe that the humans cannot fathom and make sense of.

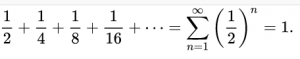

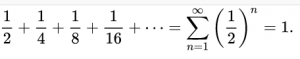

- A way to remedy this would be to set up a system whereby for any income from a product sold on a market place could be dissected into another infinite, yet limited series.

- One example is:

- Taking Bitcoin, for example, which divides into 100 million satoshis; if some payment of 1 bitcoin was received, 1/2 could be provided to one address at the first time interval (e.g. 1 month) then the rest of the funds could be received in decreasing amounts until the whole 1 is reimbursed.

- A deflationary monetary unit like Bitcoin or similar cryptocurrencies is ideal for this set-up.

- This can replace the wage system, so that a group of collaborators can divide a payment sum into equal parts that are paid into associated addresses in timely amounts.

- So for the amount of satoshis of 10-8

- This results in around 26 payments (n) of (1/2)n

- In a deflationary monetary system the decreasing monthly (or other timely) payments would not be a problem as the theoretical value of any one unit of medium exchange would increase slightly in relation to any inflationary currencies.

- Any additional proceeds from market selling of goods and services can accumulate ontop of the initial (1/2)n amounts but as its a limited infinite series its based on, it’ll always have a limiting factor.

- Capitalism can be viewed as the privatisation of the commons – enabled by intrinsically selfish and parasitical beings.

- By taking on such a limiting procedural payment system, it gives a limiting factor on how much the parasitical elements of humanity can derive from productive forces.

- Other elements of the cryptocurrency milieu could also help in this respect – multisignature payments, smart contracts, flare consensus protocols etc…

- At the start of the collaboration, contributors could give their respective personal payment addresses.

- An overall payment address can be initiated that the quorum of collaborators can agree on.

- This is given to the taker of products/service who thus pays.

- The payment address immediately splits the funds to the contributors.

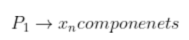

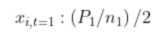

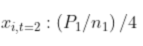

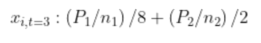

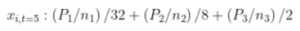

- Example, payment for a product/service P will be divided into its constitituent parts and paid out to the n contributors, x at time t :

- The timings of the payments could coincide with the production cycles and overlap, with a variable number of contributors [flexible per cycle, no contracts of employment, payments ensured by the initial agreed protocol] e.g:

- Security and technological awareness training can help the system function smoothly minimising bad actors.

![]()

![]()

![]()

![]()

![]()

![]()